TaxJar: Conquer Sales Tax Compliance With AI-Powered Automation | Martech Zone

Navigating the labyrinth of sales tax regulations can be daunting for any business owner. The ever-changing landscape of rules, rates, and exemptions across different jurisdictions can quickly turn into a compliance nightmare. Managing sales tax calculations, filings, and remittances can consume valuable time and resources that could be better spent on growing your business. What if there was a way to automate these processes and ensure accuracy while staying ahead of your obligations?

TaxJar

TaxJar, now a Stripe company, is a cloud-based sales tax compliance platform designed to simplify and automate sales tax management for businesses of all sizes. By integrating with popular e-commerce platforms and ERP systems, TaxJar provides a comprehensive solution to handle sales tax calculations, reporting, filing, and remittance, eliminating the complexities and headaches associated with sales tax compliance.

The platform leverages advanced technology, including its AI-powered engine, Emmet, to provide accurate sales tax calculations, product classification, and nexus tracking. This ensures that businesses can confidently manage their sales tax obligations while minimizing the risk of errors and penalties.

With TaxJar, businesses can experience a range of benefits, including:

- Increased efficiency: Automate time-consuming tasks like sales tax calculations, reporting, and filing, freeing up valuable time and resources.

- Improved accuracy: Minimize errors and reduce the risk of audits with TaxJar’s reliable sales tax calculations and reporting.

- Reduced stress: Gain peace of mind knowing that your sales tax compliance is handled accurately and efficiently.

- Enhanced scalability: Easily manage sales tax across multiple states and channels as your business grows.

TaxJar Features

TaxJar offers a comprehensive suite of features designed to streamline and automate sales tax compliance.

From accurate calculations to automated filing, here’s a closer look at what TaxJar provides:

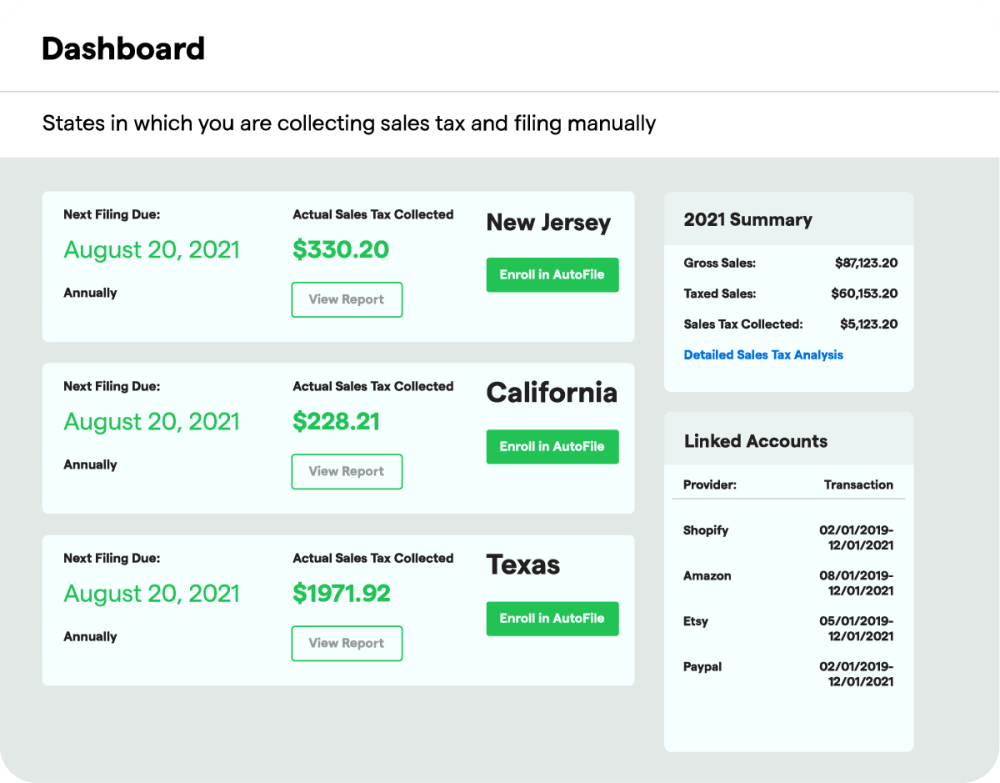

- AutoFile: Automatically prepares and submits accurate returns and remittances to every state where you’re registered, ensuring you never miss a deadline.

- Comprehensive Sales Tax Reports: Provides a consolidated view of your multi-channel transactions and offers detailed state-by-state reports with breakdowns for city, county, and special districts.

- Economic Nexus Tracking: The Nexus Insights Dashboard and notifications help you monitor your sales tax obligations and stay informed about potential Nexus triggers in new states.

- Emmet, the AI-Powered Sales Tax Expert: Intelligently suggests the correct product tax codes for your products, eliminating manual categorization and ensuring accuracy.

- Integrations: Seamlessly integrates with popular e-commerce platforms (Shopify, Walmart, BigCommerce, and more) and ERP systems (Netsuite), simplifying data management and automation. The TaxJar API gives you even more flexibility for custom solutions.

- Real-Time Sales Tax Calculations: This feature provides 99% accuracy for rooftop-level, product-specific sales tax calculations, ensuring compliance at checkout.

- Support: This company offers extensive resources, including a knowledge base, technical documentation, and a dedicated customer support team to assist with any questions or issues.

Getting started with TaxJar is simple. Connect your e-commerce platform or ERP system, determine your economic nexus, and let TaxJar handle the rest. The platform automatically calculates sales tax, tracks your nexus, generates reports, and files returns.

TaxJar definitely saves us time and money. With TaxJar, our team saves about a week per month for one employee, versus filing our taxes manually.

Senior Accountant at Plant Therapy

Ready to experience the ease and efficiency of automated sales tax compliance?

Try TaxJar for free today!