Mobile conversion rates represent the percentage of people who opted to use your mobile app or mobile-optimized website out of the total number of people offered. This number will tell you how good your mobile campaign is and, with attention to detail, what needs to be improved.

Many otherwise e-commerce retailers see their profits plummet regarding mobile users. Shopping cart abandonment rates are ridiculously high for mobile websites, and that is if you’re lucky to get people to look through the offer.

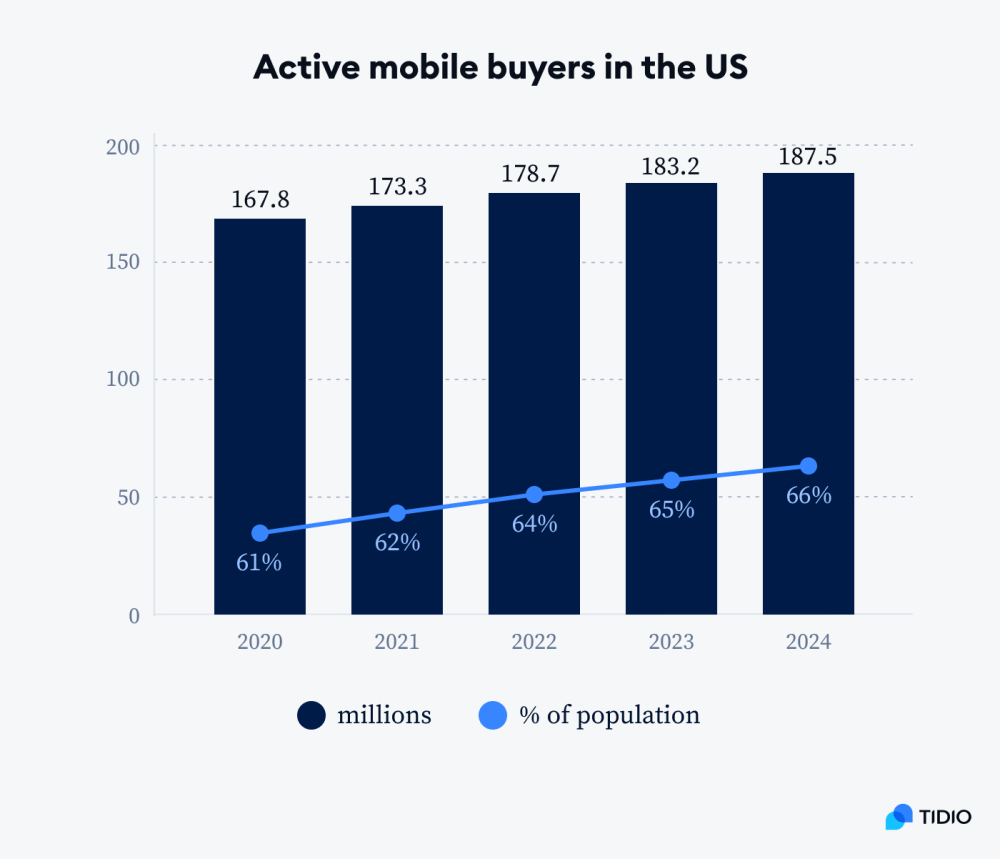

But how is this possible when the number of mobile shoppers grows by tens of millions yearly?

By 2024, there will most likely be over 187 million active mobile shoppers in the US alone

Mobile devices have evolved far from their original purpose. If we’re being honest, calls and texts are not the primary function of smart devices for most of the population anymore. A mobile device has become an extension of a modern human and serves almost every conceivable purpose, from the nimble secretary to the online shopping cart.

This is why seeing a cell phone as another medium is not enough anymore. Apps, sites, and payment methods must be adjusted and reinvented exclusively for these devices. One of the most revolutionary methods for mobile transactions is e-wallet money management, which is the topic of this article.

Improving Mobile Conversion Rates

irst of all, let’s make one thing clear: Mobile commerce is taking over the e-commerce world very, very quickly. In just five years, it rose by almost 65% and now holds 70% of the total e-commerce market. Mobile shopping is here to stay and even take over the market.

The Problems

Surprisingly enough, shopping cart abandonment is still much higher on mobile websites than for the same content viewed on desktop computers. This is a big problem for everyone, especially small retailers and companies that are new to the transition. Why does this happen?

First of all, there is the obvious. Mobile websites are usually poorly implemented, and for a good reason. There are so many devices, sizes, browsers, and operative systems that making a decent mobile-friendly website requires significant resources and time.

Searching and navigating a mobile website with tens or hundreds of shopping items can be very tiring and frustrating. Even when the customer is stubborn enough to go through all of that and proceed to checkout, not many have the nerve to enter the entanglement of a payment process.

There is a more elegant solution. It might be a bit more costly initially, but it pays itself off quickly. Apps are a much better solution for mobile devices. They are made specifically for mobile usage and are infinitely more pleasant to look at. And as we can see, mobile apps have a significantly lower shopping cart abandonment rate than desktop and mobile websites.

The Solutions

Mobile Apps

Retailers who transitioned from mobile websites to apps have seen a considerable increase in revenue. Product views rose by 30%, items added to the shopping cart rose by 85%, and overall purchases rose by 25%. Simply put, conversion rates are better through and through with mobile apps.

What makes the apps so appealing to users is their intuitive navigation. After all, they are made for mobile devices. A survey showed that most customers value convenience, speed, and the possibility of using one-click purchases with saved e-wallets and credit cards.

Digital Wallets

The beauty of digital wallets is their simplicity and built-in security. When a transaction is made using a digital wallet, no data about the buyer is revealed. The transaction is recognized by its unique number, so no one in the process can access the user’s credit card information. It’s not even stored on the user’s phone.

The digital wallet is a proxy between the actual funds and the market. Most of these platforms offer an online payment method called a one-click purchase, meaning that there is no need to fill out any forms or give out any information—as long as the app allows e-wallet payment.

Some of the most popular digital wallets today are:

- Android Pay

- Apple Pay

- Samsung Pay

- Amazon Pay

- PayPal One Touch

- Visa Checkout

- Skrill

As you can see, some are OS-specific (although most experiment with crossovers and collaborations), but most independent digital wallets are available across all platforms and are very flexible. They offer support for multiple credit and debit cards, voucher payments, and cryptocurrency.

Integration

Whether you build an app from scratch to suit your specific needs and aesthetic demands or use a ready e-commerce platform, digital wallet integration is necessary. If you’re using a platform, most of the hard work has already been done.

Depending on your business type and location, e-commerce platforms will help you choose the best e-wallets for your target group. The only thing left for you to do is implement those payments.

If you want to build from scratch, it would be wise to start with a wider set of e-wallet options and then follow the metrics. Certain digital wallets might be in more demand than others, and this widely depends on your location, goods you’re selling and the age of your customers.

There are several guidelines here.

- Where are your customers? Every region has its own favourites, and you need to be sensible about this. A blanket rule for worldwide retail is PayPal. But if you know that a large portion of your sales come from China, you should include AliPay and WeChat. Russian Federation customers prefer Yandex. Europe has a huge user base for Skrill, MasterPass, and Visa Checkout.

- Which devices are the most popular? Look at your metrics. If many of your buyers use iOS, it would be wise to include ApplePay. The same goes for Android Pay and Samsung Pay.

- What is the age span of your customers? If you’re mainly dealing with young people, including digital wallets like Venmo is a hard yes. Many people aged 30-50 work remotely or as freelancers and rely on services like Skrill and Payoneer. We all know that Millenials are not the most patient bunch, and will surely abandon a purchase if they don’t see their favourite payment option.

- What goods are you selling? Different merchandise draws different mentalities. If gambling is your turf, WebMoney and similar platforms that offer vouchers are a good choice since they are already popular in the community. If you sell games and digital merchandise, consider implementing e-wallets supporting cryptocurrencies.

If you’re not sure where to go, talk to your customers. Everyone loves to be asked for an opinion, and you can turn this to your advantage by offering short surveys. Ask your buyers what they would love to see in your store, how you can improve their shopping experience, and which payment methods they feel most comfortable with. This will give you a good direction for future upgrades.

Final Word

E-commerce is available to everyone. It has made selling goods to everyone everywhere easy—and hard at the same time. The science and statistics behind this ever-changing market are not easy to entangle.

The mentality of the average consumer has changed a lot in the past 10 years, and you must act accordingly. Learn and adapt because the digital world’s evolving pace is mind-blowing.