Automate the books

Intacct’s Web-enabled financial suite eases application integration

ALTHOUGH MOST OF the buzz about enterprise integration has focused on front-office applications such as sales force automation and online shopping malls, financial software is arguably the true source of most integration-related headaches. After all, enterprises must invest considerable time and effort just to develop basic functionality, such as a program that can automatically post sales transaction to a company’s books.

It’s even worse for small and midsize companies, which often must hire outside help to develop ad-hoc programmatic links between their accounting systems and other applications. Because they often lack staff accountants, smaller companies stand to benefit from the advice of accountants in designing bookkeeping strategies that support their business goals. But where’s the money to finance those kinds of projects?

If any of this sounds familiar, Intacct may have the perfect solution: a comprehensive suite of financial applications, offered through partners as a subscription service, that users can access from a Web browser.

Intacct’s solution, also called Intacct, is a financial suite that offers basic software modules for functions such as general ledger, accounts receivable, accounts payable, inventory management, order entry, and purchase orders. And thanks to an XML-based structure that makes connecting to software from other vendors easy, Intacct also offers preintegrated applications from business partners for functions such as payroll, financial analysis, and online bill payment. Think Web services without the UDDI (Universal Description, Discovery, and Integration) layer.

Turning the configuration wheels

Although it boasts many strengths, Intacct’s extreme flexibility is probably its most noteworthy characteristic. The solution offers a powerful collection of administrative tools that allow users to adjust its modules to a wide range of different requirements. For example, the inventory module allows you to manage products in multiple warehouses, keep track of an unlimited number of preferred suppliers for each item, or define the most appropriate cost and pricing methods.

But that flexibility comes with a price: Intacct’s setup routine is unusually complex. The average user is likely to be overwhelmed by the numerous control points that must be tweaked and twiddled before Intacct can go live.

At least Intacct’s third-party provider delivery system helps mitigate that shortcoming. The providers — a group of both systems integrators and accounting specialists — can help users deal with the intricacies of adjusting and administering Intacct by defining basic accounting rules (a nontechnical activity).

They also can make daily use simpler by restricting Intacct’s GUI to display only authorized applications.

Moreover, to enable the creation of custom accounting systems, Intacct gives its providers an extensive set of tools, including preconfigured templates, configuration wizards, and software that can import data from popular file formats. In short, Intacct’s provider-based model turns a possible disadvantage — the complexity of the solution — into an opportunity for customers to get a professionally prepared accounting system, tailored to their unique requirements.

Integration station

Although Intacct does offer an extensive range of accounting modules, the company does not attempt to cover the whole spectrum of business applications. Front-office tools, such as CRM and online shopping applications, are absent from the package. That may not be a problem for some companies, but organizations with more onerous needs might be better off looking at packages such as Oracle’s Small Business Suite or using Intacct’s flexible XML-based integration features.

The optional XML Developer Kit offers an easy medium for integrating other applications that feature consistent APIs to retrieve Intacct data, such as customer or product information, or to post transactions. Intacct complements the kit with its XML Gateway, which controls programmatic access to accounting databases, and an online test playing field where developers can debug integration code.

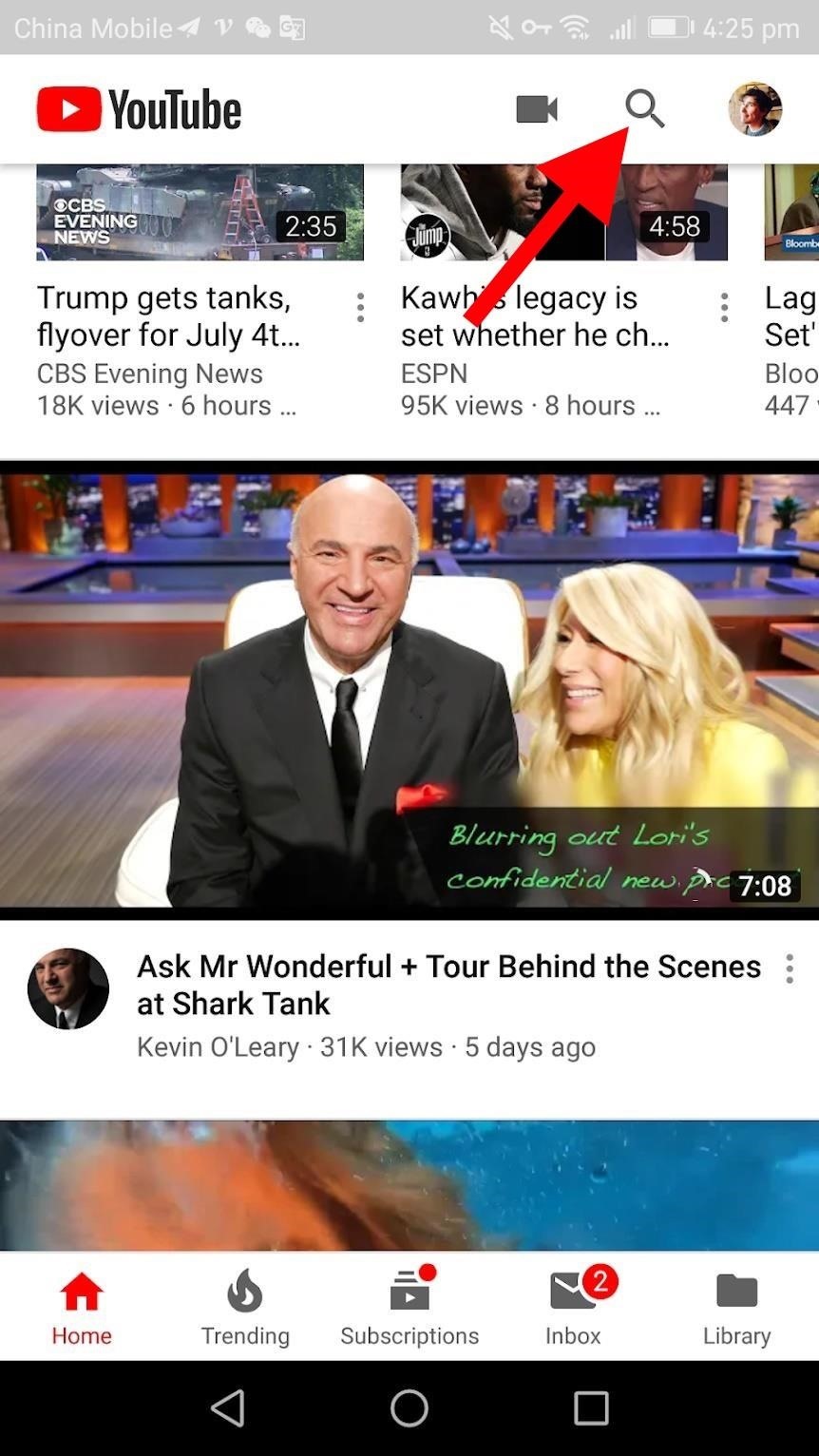

For our review, we accessed a test account with user and administrative rights from Internet Explorer over a DSL connection. Intacct has an excellent, context-sensitive help procedure that includes conceptual descriptions and step-by-step guides for each transaction. If you’re still confused, you can initiate a chat session with Intacct’s technical support staff.

We chose the accounts receivable application, and immediately Intacct presented us with a diagram of the available transactions, which are preset by the provider during the setup process. Clicking each icon opened a more detailed screen that changed according to each transaction.

To minimize data entry, we also could select the content of each field from a list. For example, to enter a new customer invoice, we only had to type the dollar amount and a general description. Other data such as the customer, terms, and general ledger accounts could be selected from lists that Intacct created on the spot for each field. In this way, Intacct’s user interface is a terrific time-saver that also helps minimize errors.

For companies seeking to integrate their accounting applications, Intacct is a compelling alternative to both in-house packages and monolithic, single-vendor suites. If your front-office applications need the support of a versatile, professionally groomed accounting system, Intacct could be your best bet.