Things are not looking too good for anyone’s economic future, given the pandemic and subsequent lockdown orders from governments around the world. I believe this is going to be a historic event that will have a massive, lasting impact on our world, from rising business bankruptcies and unemployment to food production and logistics. If nothing else, this pandemic has shown how frail our global economy is.

That said, a forced situation like this makes consumers and businesses adapt. As businesses do their part and have employees work from home, we see mass adoption of video communications. Perhaps we’ll reach a level of comfort with this activity where business travel can be reduced in the future, bringing down operating costs as well as helping the environment. It’s not good news for the travel and airline industries, but I’m certain they’ll adapt.

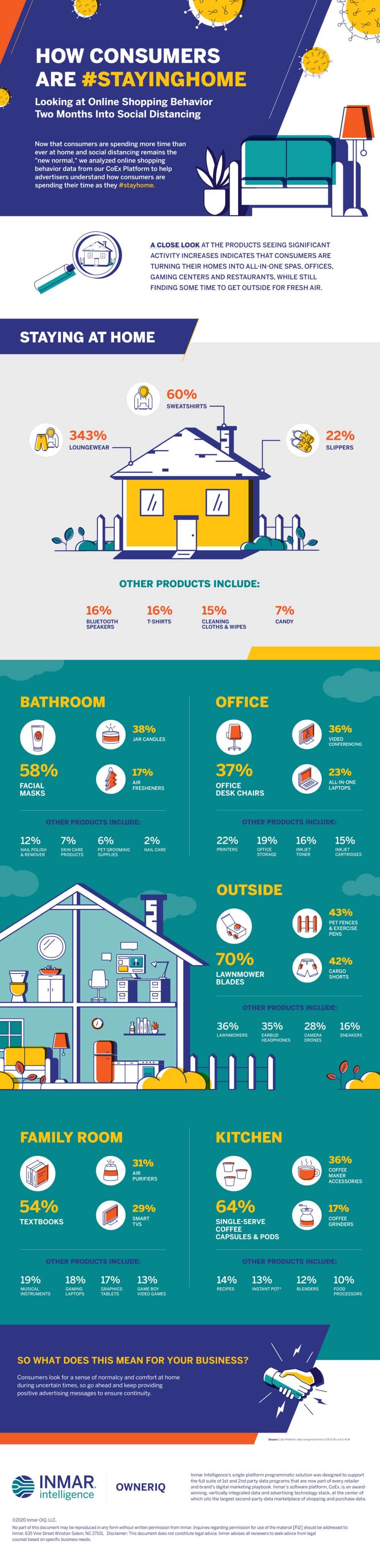

OwnerIQ, acquired by Inmar in Q4 2019, provides insight into how consumers are adapting to their new normal of staying at home, shopping from home, and adjusting their purchase behavior to products accordingly. OwnerIQ analyzed online shopper data from their CoEx Platform to provide the information they graphically presented in their infographic, How Consumers are #StayingHome.

Consumer COVID-19 Behavior Changes

The infographic highlights online shopping behavior during the early months of the COVID-19 pandemic, emphasizing how consumers adapted to the new normal of social distancing and home confinement. Key insights include:

- Increased Focus on Comfort:

- Homebound consumers now working from home (WFH) shifted their purchasing patterns towards products that enhance comfort and productivity at home. The data shows significant surges in sales of items like loungewear (343%), sweatshirts (50%), and slippers (22%).

- Other home-focused items seeing a rise in demand include Bluetooth speakers (16%) and cleaning supplies (15%).

- Product Categories Showing Growth:

- Bathroom: Items such as facial masks (58%) and air fresheners (38%) have grown in popularity.

- Office: With many working from home, office chairs (37%) and video conferencing equipment (36%) have become essential purchases.

- Family Room: Textbooks (54%) and smart TVs (29%) lead in this area.

- Kitchen: Coffee products, including single-serve pods (64%), and instant pots (13%) are notably popular.

- Outdoor Purchases: While indoors, consumers are also paying attention to their outdoor spaces, with significant interest in lawnmower blades (70%), fencing (43%), and cargo sheds (42%).

Takeaway for Businesses: Companies should tailor their marketing strategies to emphasize comfort, productivity, and home improvement. Messaging that acknowledges the current uncertainties and offers convenience and normalcy will likely resonate well with consumers during this period.

This trend in consumer behavior presents an opportunity for businesses to focus their advertising efforts on products that enhance the home experience, whether it’s through comfort, entertainment, or productivity.